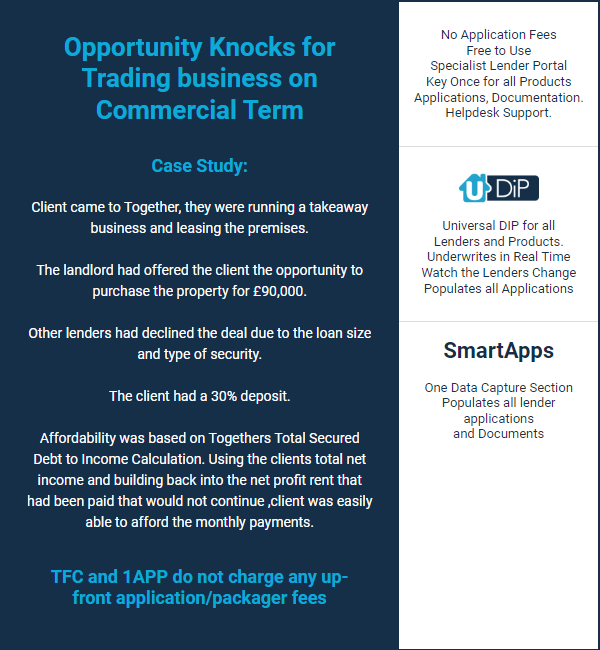

Opportunity Knocks for Trading business on Commercial Term

Case Study:

Client came to Together, they were running a takeaway business and leasing the premises.

The landlord had offered the client the opportunity to purchase the property for £90,000.

Other lenders had declined the deal due to the loan size and type of security.

The client had a 30% deposit.

Affordability was based on Together’s Total Secured Debt to Income Calculation. Using the client’s total net income and building back into the net profit rent that had been paid that would not continue, client was easily able to afford the monthly payments.

Other reasons to work with Together for Commercial Term Business

All commercial property types considered on merit including, Retail, Hotels, Industrial, offices, restaurants, food outlets & leisure, community & healthcare.

- Commercial, semi-commercial & Land accepted

- Employed & self-employed applicants accepted

- No minimum income

- Minimum loan Size £30k

- 100% funding available with additional security

- No minimum trading period

- Up to 70% LTV

- Affordability assessed on either Total secured Debt to Income ratio or rental income – 120% ICR

- Individuals, sole traders, Limited companies,LLPS, and partnerships accepted

- Expats and Non- UK nationals accepted

| No Fees |  | SmartApps |

|---|---|---|

| No Application Fees Free to Use Specialist Lender Portal Key Once for all Products Applications, Documentation. Helpdesk Support. | Universal DIP for all Lenders and Products. Underwrites in Real Time Watch the Lenders Change Populates all Applications | One Data Capture Section Populates all lender applications and Documents |

TFC, working with intermediaries for over 30 years.

Ask our team about our great exclusives

Save Time use 1APP

It is FREE to use

1 Login to access all our lenders and products

1 DIP for all our lenders and products